Safe Harbor 401(k) Cost Calculator showing how much a safe harbor plan will add to payroll costs. Small businesses shouldn't think that their only option for avoiding compliance issues is to roll out a safe harbor plan, said Esther Trapadoux, a content marketer at San Francisco-based retirement plan advisors ForUsAll, which provides plan services for small businesses.

#DC PLAN SAFE HARBOR CODE#

Regardless of a 401(k) plan's safe harbor status, Droblyen said, profit-sharing contributions must satisfy nondiscrimination testing under tax code Section 401(a)(4) to show that the benefits provided to highly compensated employees are proportional to those provided to non-highly compensated employees. The study found that 85 percent of small business plans allow employers to make discretionary profit-sharing contributions, and that profit-sharing contributions are most commonly combined with a 3 percent match-based safe harbor 401(k) plan design. QACA safe harbor contributions can be subject to up to a two-year cliff vesting schedule, under which the employee has no vested interest in any employer contributions until the employee completes the required years of service. A default-deferral rate that must start at no less than 3 percent of the employee's compensation and increase at least 1 percent annually to no less than 6 percent (with a maximum of 10 percent of compensation).A 100 percent match on the first 1 percent of compensation deferred and a 50 percent match on deferrals between 1 percent and 6 percent (up to 3.5 percent of an employee's compensation).Such plans include the following features: These plans automatically enroll in the plan any eligible employee who fails to make an affirmative enrollment election at a specified deferral rate. The enactment of the Pension Protection Act of 2006 introduced a newer type of safe harbor 401(k) plan, the qualified automatic contribution arrangement (QACA). Non-highly compensated employees-those earning less than $120,000 in 20. Employer provides a contribution of at least 3 percent of each plan-eligible employee's salary, even if an employee is not making elective deferrals.įor the above safe harbor matching and nonelective contributions, employees must be 100 percent immediately vested. Under a safe harbor nonelective contribution: A common formula is a 100 percent match on the first 4 percent of deferred compensation.

Employer provides an alternative formula that must be at least as much as the basic match at each employee-deferral percentage tier.

#DC PLAN SAFE HARBOR PLUS#

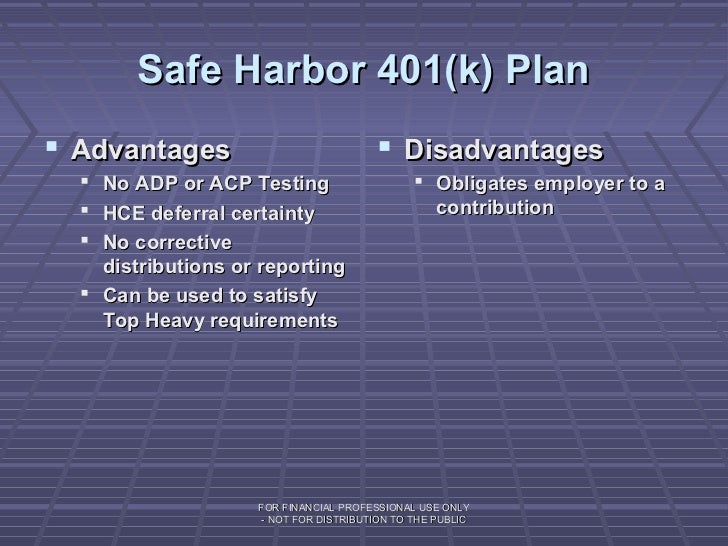

Employer provides 100 percent matching on the first 3 percent of an employee's deferred compensation plus a 50 percent match on deferrals between 3 percent and 5 percent (up to a total of 4 percent of an employee's compensation). Under a safe harbor matching contribution, two options are available: Safe harbor 401(k) plans, Droblyen explained, typically require an employer to make either an eligible matching or nonelective contribution to participants.

He added, "Given these consequences, it's little wonder why business owners find safe harbor 401k plans attractive." They often receive the largest 401(k) refunds when the ADP/ACP test fails and they must generally make a 3 percent contribution to non-owners when the top-heavy test fails." "Small businesses tend to fail more because business owners generally have a larger percentage of plan assets. "When 401(k) testing fails, it's usually business owners that bear the brunt of the consequences," along with highly compensated employees, said Eric Droblyen, president and CEO of Employee Fiduciary. Nondiscrimination rules for deferrals and matching contributions under theĪctual contribution percentage (ACP) tests.

The IRS treats safe harbor plans as satisfying annual 30 by Mobile, Ala.-based Employee Fiduciary, a provider of 401(k) services for small businesses. Sixty-eight percent of small business 401(k) plans use a safe harbor design to avoid annual compliance testing.Ī 2016 study of 2,767 plans, averaging 25 participants and $947,000 of plan assets, published Nov.

0 kommentar(er)

0 kommentar(er)